Some variable annuities, however, additionally offer a repaired account option that pays a set rate of interest. For objectives of monetary disclosure, an "possession" describes a rate of interest in home kept in a profession or company or for financial investment or the manufacturing of revenue. OGE has actually determined that particular items, by their nature, are held for financial investment or the production of revenue, despite the subjective belief of the asset owner.

If you are unable to make a good belief quote of the worth of a property, you might suggest on the report that the "worth is not conveniently ascertainable" in lieu of marking a classification of value. Keep in mind, however, that you usually should be able to make an excellent belief estimate of worth for running businesses.

A lending protected by a boat for personal use is usually reportable. Corporations concern bonds to raise money.

Some bonds are secured by collateral, while others, such as debentures, are backed just by the firm's excellent faith and credit report standing. Local bonds, usually called munis, are debt commitments of states, cities, counties, or various other political neighborhoods of states in the USA. Both main sorts of local bonds are general responsibility and income.

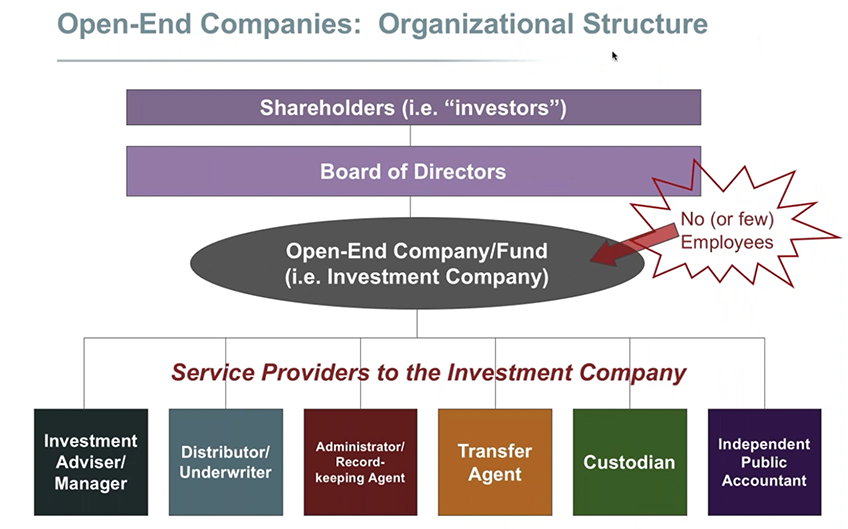

Investment Company servicing Tyler

The person that develops the account has the financial investments in that account. You are not needed to report assets of a trade or business, unless those passions are unconnected to the operations of business. What makes up "unassociated" will vary based upon the certain situations; nevertheless, the following basic standards use: Publicly traded companies: Properties of an openly traded company are regarded to be associated with the operations of the company for purposes of monetary disclosure.

A resources commitment is a lawful right coming from a contract that permits a financial investment company to demand money that an investor has actually consented to contribute. For example, when a financier buys into a financial investment fund, the financier may not have to contribute every one of the money that the investor has actually promised to offer the company that takes care of the investment fund.

When the financial investment fund is ready to purchase investments, the company will issue a funding phone call to its investors in order to raise money for the investment fund's acquisitions, at which time the investors will need to contribute their guaranteed funds to the company. Carried interests are additionally called "profit rate of interests" and "incentive fees." For objectives of economic disclosure, a carried rate of interest is an arrangement that states the right to future settlements based upon the performance of a mutual fund or organization.

The employer usually makes investment choices concerning the holdings of the plan and births the risks of investment. Every year, the staff member gets a pay credit scores that is symmetrical to a portion of the employee's salary and a revenue credit that is a fixed price of return. The employer specifies this retirement benefit as an account balance, and a money balance pension will certainly typically enable a staff member to pick between an annuity and a lump-sum repayment.

Instances of such items consist of art job, vintage vehicles, antique furniture, and uncommon stamps or coins. A common trust fund of a financial institution is a depend on that a financial institution manages on behalf of a team of taking part clients, in order to invest and reinvest their payments to the count on jointly.

Mineral Rights Companies around Tyler

The name of a source of payment may be left out only. if that information is particularly established to be confidential as an outcome of a privileged partnership developed by law; and if the disclosure is particularly prohibited: a. by legislation or law, b. by a rule of a specialist licensing organization, or c.

It is uncommon for a filer to count on this exception, and it is incredibly rare for a filer to count on this exception for greater than a couple of clients. Instances of circumstances that fall under among the 3 requirements laid out above consist of: the customer's identification is safeguarded by a law or court order or the customer's identity is under seal; the client is the topic of a pending grand court proceeding or various other non-public investigation in which there are no public filings, declarations, appearances, or records that recognize the client; disclosure is prohibited by a guideline of expert conduct that can be implemented by a professional licensing body; or a created confidentiality contract, participated in as your services were preserved, specifically forbids disclosure of the customer's identity.

The candidate has a pre-existing confidentiality contract, an IT professional would certainly not usually have a "blessed relationship established by law" with clients. The privacy arrangement is a pertinent standard just if there is currently a blessed partnership. The term "contingency charge" describes a kind of fee setup in a case in which an attorney or company concurs that the payment of legal costs will certainly rest upon the effective end result of the situation.

The details arrangements for a backup charge case need to be set forth in a fee arrangement, which is an agreement between the attorney (or law practice) and the client that explains the terms of the representation. Co-signed financings are lendings where a lawful obligation to pay has actually resulted from co-signing a cosigned promissory note with one more.

Navigation

Latest Posts

Landscape Design Companies

Landscape Design servicing Tyler, Texas

Landscape Design Contractor local to Tyler, Texas