Table of Contents

The ownership rate of interests of capitalists are represented by 'systems', which are released and redeemed in a manner comparable to a device trust fund. The CCF is an unincorporated body, not a different lawful entity and is transparent for Irish legal and tax objectives. Because of this, investors in a CCF are dealt with as if they directly own an in proportion share of the underlying investments of the CCF as opposed to shares or systems in an entity which itself owns the underlying investments.

Tax obligation transparency is the main feature, which sets apart the CCF from other kinds of Irish funds. The CCF is authorised and regulated by the Reserve bank. Please note that this website is not meant to address questions concerning specific financial investments nor is it intended to give expert or lawful advice.

Our team believe all platforms need to pass on ballot civil liberties for the firms you spend in, so you can have your say as a shareholder. Numerous systems do this if you 'decide in', but others do not, which leaves financiers at night or even unable to elect. The AIC's 'My share, my vote' project is combating to transform this.

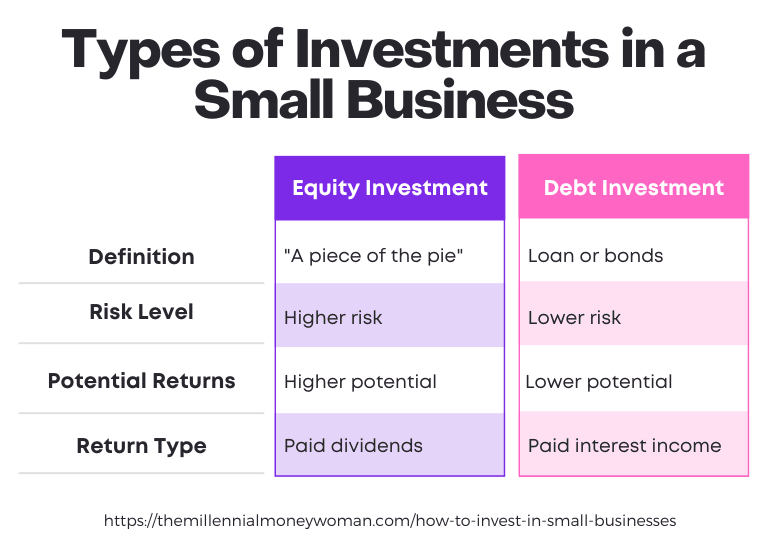

The act likewise provides for the regulation of shared fund managers by CIMA. Not all mutual funds are regulated.

Investment Company in Tyler

The groups of funds managed under the MFL are set out listed below. The MFL (Area 4( 1 )) defines that a mutual fund operating in and from the Cayman Islands should have a licence unless: a certified shared fund administrator is giving its primary office; it satisfies the criteria laid out in Section 4( 3 ), which allows for funds to be registered, or it is excluded from regulation under Section 4( 4 ).

The four vehicles typically utilized for running shared funds are the excused business, the segregated profile company, the device count on and the excused restricted partnership. The spared firm might retrieve or buy its very own shares and might consequently run as an open-ended business fund. Closed-ended company funds can likewise be developed making use of the exempted firm and it is a reasonably simple treatment to convert from one to the various other.

The SPC makes it possible to provide a way for different groups to safeguard their assets when carrying on business via a single legal entity. The system count on is generally developed under a trust fund act with the financiers' passion held as depend on systems. The exempted and restricted collaboration gives a 2nd unincorporated car and it can be developed as quickly as the spared company or the unit trust fund.

Have you experienced a significant occasion in your life that has transformed your financial circumstance? Are you looking past a typical cost savings account to begin to spend in supplies, bonds or other investment products!.?.!? Probably you're seeking somebody to assist establish a road map for your financial future. These and other circumstances could make you take into consideration getting in touch with an investment expert.

Investment Management

Below are the most typical kinds of investment experts and essential functions. Comply with the web links for more information about each. Registered financial specialists deal protections for their customers, consisting of specific financiers. They're managed by FINRA and the SEC. Learn a lot more. Investment consultants offer guidance regarding securities customized to the requirements of their clients.

Discover extra. Financial organizers give a range of monetary services that vary from carrier to carrier. Guideline and licensing depend on the solutions offered. Discover more. Insurance coverage representatives sell life, health and wellness and building insurance policy policies and other insurance items, including annuities. They're controlled by state insurance policy compensations. Find out more. Accountants supply professional assistance with tax obligations and financial planning, tax coverage, bookkeeping and monitoring consulting.

Discover more. Lawyers provide legal assistance to customers associated with financial preparation and investment choices and might represent clients in disagreements with companies or financial investment specialists. They're managed by state bar associations. Discover more. A great place to begin when purchasing for an investment professional is to ask household, pals and associates who already spend for the names of individuals they have actually used.

The complying with actions will certainly assist you make a sound option:, consisting of examining to see if a person has a criminal record. Do this you authorize any kind of papers, make any kind of financial investments or pass on any cash. A vital action in selecting a financial investment specialist is to see if the private and their company are registered.

The SEC Has practical details and suggestions on exactly how to pick a financial investment professional. These include: What experience do you have dealing with people like me? That are you registered with and in what capability? Do you hold any kind of various other expert qualifications? Do you have any type of disciplinary activities, adjudication awards or customer complaints? If so, please describe them.

Investment Firms around Tyler

Level with your expert concerning your investing experience and the quantity of risk you agree to take. Steer clear of any investment professional who pushes you to invest rapidly or rejects to offer details for you to take into consideration thoroughly. Look out to high stress tactics that are regularly utilized by financial scammers.

An American depositary invoice (ADR) is a certificate representing shares of a foreign safety and security. It is a form of indirect possession of international safety and securities that are not traded straight on a nationwide exchange in the United States. Economic institutions purchase the underlying securities on fxes through their foreign branches, and these international branches stay the custodians of the protections.

Several ADRs are registered with the united state Stocks and Exchange Payment and traded on national exchanges; however, some ADRs are not registered and traded on national exchanges. Investors acquire these non-registered ADRs directly from their issuers or with various other personal professions (i.e., "over-the-counter"). An "American depositary share" represents a single share of the underlying safety.

Navigation

Latest Posts

Landscape Design

Investment Management around Tyler, Texas

Investment Management Companies